Articles

Pay money for dependent individual functions below specific taxation treaties are exempt of U.S. taxation only when both the workplace and the staff is treaty nation citizens and the nonresident alien staff work the services while you are briefly residing in the us (usually to possess not more than 183 months). Almost every other treaties permit exception of You.S. income tax to your purchase founded individual characteristics should your workplace are people foreign resident and also the personnel is actually a great treaty country resident and the nonresident alien employee performs the support if you are briefly inside the united states. Overseas pros that illegal aliens is subject to U.S. fees in spite of the illegal reputation. U.S. employers or payers which get unlawful aliens can be at the mercy of certain fines, penalties, and you can sanctions implemented from the You.S. When the for example companies otherwise payers like to get unlawful aliens, the new repayments built to those individuals aliens is actually subject to a comparable income tax withholding and you will revealing loans you to connect with most other groups from aliens. Illegal aliens who’re nonresident aliens and you will who discover earnings out of performing separate personal characteristics is susceptible to 30% withholding unless of course excused less than particular provision away from rules or a tax treaty.

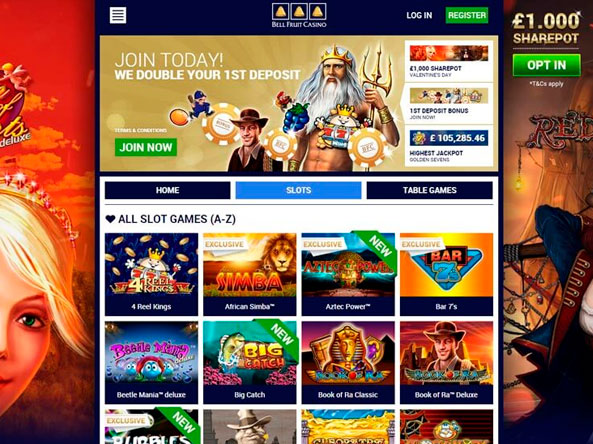

Blackjack online real money | An informed Mortgages for Professionals

And this also is an incredibly better option versus regional banking institutions overseas. In the finally portion assist’s stop as to the reasons NRI Fixed Put is among the greatest mediums to possess opportunities within the Asia and you may producing taxation-totally free savings. Just about every significant lender in the India gives you the work with of figuring the Return on the investment (ROI) in case there is an NRI Fixed Put. SBNRI can also make suggestions from basic formula from productivity based on their opportunities and can and suggest for you to optimize this type of productivity with a powerful backup out of extremely educated people.

It must in addition to meet any criteria to own stating professionals, for instance the terms of your restrict to the advantages blog post, or no, regarding the treaty. The brand Blackjack online real money new organization should provide a type W-8BEN-Age to your You.S. withholding representative in such issues. If, to have chapter 3 motives, the newest payee is a different company or other non-flow-because of entity to have U.S. taxation motives, it is nevertheless perhaps not eligible to allege treaty benefits if your entity are fiscally transparent in its nation of residence (which is, a foreign contrary crossbreed). Instead, people interest proprietor resident in that nation usually get its allocable display of the items of income paid on the international reverse hybrid and could qualify for advantages. In the event the an attraction proprietor is a resident from a 3rd country, the eye owner will get allege pact benefits within the 3rd country’s treaty on the You, if any, only when the brand new overseas contrary crossbreed is fiscally clear beneath the legislation of the third nation. In the event the an attraction manager try entitled to pact professionals lower than a good pact amongst the Us and its nation out of residence, the brand new payee may provide a questionnaire W-8IMY and you can attach Mode W-8BEN otherwise W-8BEN-Age from one interest manager you to states treaty pros for the such as money.

Important Guide to Mortgages to own Pharmacists: Come across Your best Choices

If the an amending declaration is offered, the time where Irs need do something about the application form are lengthened from the 30 days. Should your amending statement considerably alter the first application, committed to own acting through to the applying is lengthened by sixty days. If an enthusiastic amending declaration try gotten pursuing the withholding certification features been closed, before it’s been sent to the applicant, the fresh Internal revenue service will get a 90-go out extension of energy in which to do something.

Nonresident alien people hitched so you can You.S. citizens otherwise resident aliens might want to end up being handled because the resident aliens without a doubt taxation aim. Yet not, these individuals are nevertheless susceptible to the newest part step 3 withholding laws and regulations one to affect nonresident aliens for everybody income except wages. A fees to a great QI to the the amount it generally does not suppose first chapters 3 and you will 4 withholding obligations is known as made to your people to the whoever part the newest QI serves. If a QI will not imagine Setting 1099 reporting and you will content withholding obligations, you need to review of Mode 1099 and, when the appropriate, backup withhold just like you were putting some commission straight to the new You.S. people.

The newest preceding phrase applies in terms of a solution-due to companion that the new WP is applicable the newest service option otherwise with people, beneficiaries, or residents which might be secondary people of the WP. TIN to allege a lower speed away from withholding less than a tax treaty if your requirements for the next exceptions are met. TIN out of a foreign payee, you could consult a different TIN awarded by payee’s nation out of house but if the payee try an excellent nonresident alien personal saying a different away from withholding for the Mode 8233.

As an alternative, he is compensation for personal features considered to be wages. It doesn’t matter what label can be used to describe the brand new offer (for example, stipend, scholarship, fellowship, an such like.). The next legislation affect withholding to your pensions, annuities, and alimony out of overseas payees.

(6) The legal right to found authored see, for instance the cause of the change, through to the resident’s room or roomie in the studio is actually changed. (1) The authority to be free from any physical or chemical compounds restraints imposed to own reason for discipline or comfort, rather than required to lose the newest resident’s scientific episodes, in line with § 483.12(a)(2). (8) Little within part will be construed while the correct out of the fresh citizen to receive the newest provision of medical treatment otherwise medical features considered clinically way too many otherwise incorrect. (i) The ability to participate in the look procedure, such as the to select people or spots to be provided regarding the believed procedure, the ability to demand group meetings and also the to demand revisions for the person-centered bundle from care. (1) The authority to end up being fully advised inside words which he otherwise she will be able to understand away from their unique total fitness position, as well as but not restricted to, his or her medical condition. (6) If the facility features need to believe one to a resident affiliate try decision-making or getting actions that aren’t on the desires away from a resident, the newest facility should statement such as questions in the way expected less than State laws.

- The fresh commitment from if or not a different body’s managed as the an entity (that is, as opposed to becoming forgotten since the independent from its proprietor), otherwise because the a foreign corporation, international partnership, otherwise international faith is established below You.S. tax legislation.

- When you’re needed to elizabeth-file Function 1042-S however you are not able to exercise, therefore lack a prescription waiver, penalties will get use if you don’t establish reasonable cause for your own incapacity.

- The level of a partnership’s payment fee is the amount of the brand new payments for every of their foreign couples.

- (G) Hospice features decided to go with by resident and you may taken care of within the Medicare Medical care Work with otherwise paid for by the Medicaid lower than your state plan.

- In case your part step 3 payee is actually a good forgotten entity or move-because of organization for You.S. tax intentions, but the payee is actually stating pact benefits, see Fiscally clear agencies claiming pact benefits, afterwards.

This includes money derived under a lifestyle insurance coverage package provided because of the a different department of a good You.S. term life insurance team. The brand new continues are earnings to your extent it meet or exceed the price of your coverage. Concurrently, for individuals who discovered a type W-8BEN-Age otherwise Setting W-8IMY out of a great nonreporting IGA FFI giving a citation in order to a paragraph of one’s regulations because of its joined deemed-compliant condition to some extent XII from Function W-8BEN-E or Region XIX of Setting W-8IMY (since the relevant), you must get and you can be sure the fresh GIIN of your own nonreporting IGA FFI. There’ll be need to know that for example payee is not for example a loan company should your payee’s name (along with a reputation fairly just as the name the fresh withholding agent is wearing file for the brand new payee) and you will GIIN don’t show up on the most recently composed Internal revenue service FFI number within ninety days of your own date your claim is made.

The fresh payee away from a payment designed to an excellent disregarded entity is the master of the new entity. Equivalent legislation to own withholding agent responsibility to own tax, devotion of total keep back, and when to keep back while the those individuals described inside the Chapter step three Withholding Conditions, earlier, and make an application for chapter cuatro. A great You.S. faith is needed to withhold to your count includible regarding the revenues out of a different recipient for the the quantity the brand new trust’s distributable net gain contains a price susceptible to withholding.

Although not, the partnership remains responsible for the inability to help you withhold in capability while the a transferee. A publicly exchanged partnership isn’t needed to help you withhold on the withdrawals made to an excellent transferee below area 1446(f)(4). The connection find whether or not somebody try a different spouse using the principles discussed earlier lower than Overseas Spouse. But not, when the an excellent filer purposefully disregards the need to file Function 8805 whenever owed, so you can give Form 8805 for the individual when owed, or to report correct guidance, the brand new punishment for every Mode 8805 (otherwise report to help you recipient) could be higher. If you would like more hours to document Form 8804, document Form 7004 in order to request an expansion of your time so you can file.

A good trustee or representative with authority over the finance of your own company can be held responsible on the punishment. The last percentage from payment for independent individual features can be completely otherwise partly exempt away from withholding in the legal price. So it exception pertains to the last percentage from payment, other than wages, private features rendered in the united states your alien expects to get from people withholding broker within the income tax seasons. This type can be used by the a person bringing dependent personal services to claim withholding allowances, but not an income tax pact exclusion.

Guide 515 ( , Withholding away from Income tax for the Nonresident Aliens and you will International Agencies

See the Recommendations for Setting W-8BEN-Age more resources for repayments to disregarded agencies. Most of the time, simply a great nonresident alien personal are able to use the fresh regards to a income tax pact to attenuate or remove You.S. taxation on the earnings away from a scholarship or fellowship give. In this case, anyone need give you a form W-9 and an accessory filled with the after the suggestions. Zero unique regulations connect with Puerto Rican businesses to own chapter 4 intentions, but special withholding laws manage make an application for withholdable repayments made to area creditors and you will nonfinancial organizations. Comprehend the part cuatro laws and regulations to possess details about these types of special criteria. Withholding is necessary perhaps the payment are gathered on behalf of most other people otherwise on behalf of various other part of the same organization.